GBPAUD Analysis | Breakout potential after a five day rally?

BY Janne Muta

|November 10, 2023GBPAUD Analysis shows a five-day rally in this currency pair after it created a higher swing low. On the fundamental side, today’s GDP report for Q3 showed, the UK economy growing modestly by 0.60% year-on-year.

Recently reported slow retail sales growth and services sector contraction reflect consumer caution and economic challenges amid high inflation.

Persistent inflation has led the Bank of England to maintain a high interest rate of 5.25% as the central bank tries balance between inflation control and economic slow-down.

In Australia, the RBA’s statement released today indicates a focus on reining in inflation, with possible for further rate hikes. Despite the economic strain on households, the RBA is prioritizing inflation control, as it is expected to remain above target until late 2025. The cash rate is anticipated to peak at 4.5% before dropping to 3.5% by 2025.

Summary of This GBPAUD Analysis Report:

- The GBPAUD is ranging between 1.8858 and 1.9327. If this sideways range is resolved to the upside, we could see the market trading to 1.9720 or so. In the opposite case of the market breaking below the range, a move to 1.8530 could be likely.

- The daily chart indicates a possible breakout above the 1.9204 resistance level in the market, following a higher swing low on November 2nd. Failure to break this level could lead to a retest of the recent low at 1.9110.

Read the full GBPAUD analysis report below.

GBPAUD Analysis

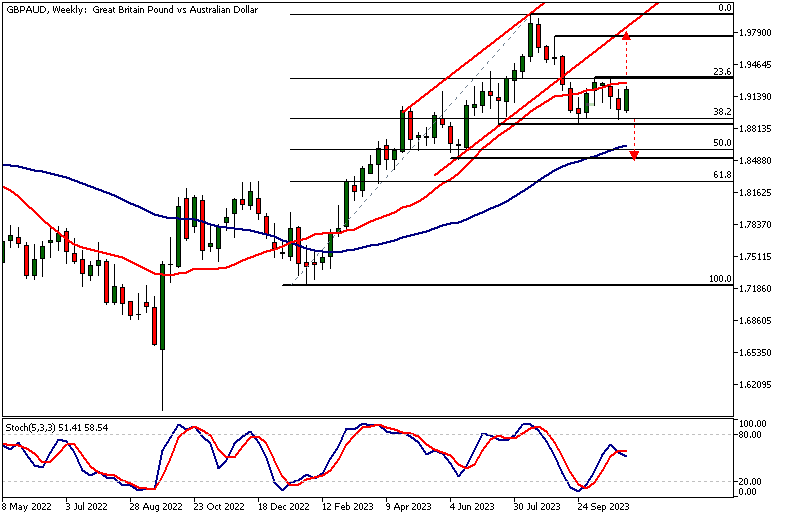

Weekly GBPAUD Analysis

GBPAUD is moving sideways between a support level at 1.8858 and a resistance level at 1.9327. The market has breakout potential as it is certain that the pair will not remain inside the price range but will eventually break out of it.

GBPAUD analysis suggests that if the market breaks above the current range, we could see an upward movement towards 1.9720 or so. In the opposite case of the market breaking below the range, a move to 1.8530 could be likely.

These potential targets are based on measured moves derived from the width of the sideways range.

Measured move projections

The measured move projections point to technical confluence areas above and below the range. The confluence area (1.9749 - 1.9807) above the current market range is created by a market structure level and the lower end of a bullish trend channel the market has broken out of.

The confluence area below (1.9500 - 1.8642) contains a market structure level, 50 period SMA, and the 50% Fibonacci retracement level.

Daily GBPAUD Technical Analysis

The daily chart shows the market trying to break above a resistance level at 1.9204. The fact that the market created a higher swing low at 1.8899 on November 2nd suggests that the resistance level could be penetrated and the market might be retesting the range high at 1.9338.

GBPAUD analysis indicates that if the market struggles to penetrate the 1.9204 resistance level, we could see a retest of yesterday's low at 1.9110.

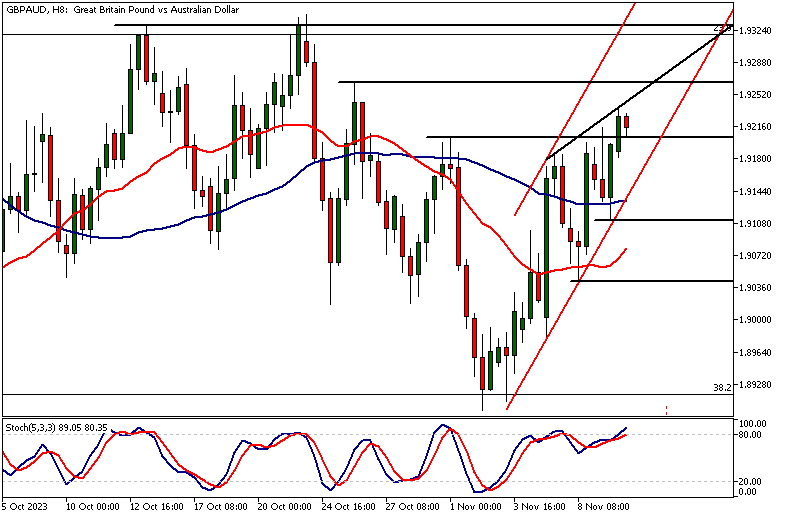

GBPAUD Analysis, 8h Chart

The 8-hour chart reveals a bullish trend channel as the market creates higher lows and higher highs. However, note that the market is creating a bearish wedge at the same time.

The wedge formation is created when each successive push higher is smaller than the previous one. In other words, GBPAUD analysis indicates the bulls are struggling to push the market through supply.

Potential bearish wedge breakout

If the lower end of the wedge, in this case, the lower end of the bullish price channel, is broken, the market could retrace to the next key support level. The key support levels below the bullish channel low are at 1.8976 and 1.9040.

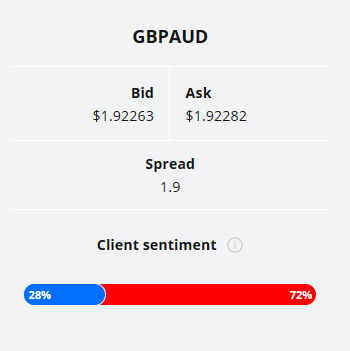

Client sentiment analysis

TIOmarkets' clients are bearish on GBPAUD , with 72% of clients holding short positions and 28% favouring the long side.

Please remember that the retail trad´+er client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

The next key risk events impacting this market:

- AUD - NAB Business Confidence

- GBP - Claimant Count Change

- AUD - Wage Price Index

- GBP - CPI

- AUD - Employment Change

- AUD - Unemployment Rate

Potential GBPAUD Market Moves

The fact that the market created a higher swing low at 1.8899 on November 2nd suggests that the resistance level could be penetrated and the market might be retesting the range high at 1.9338.

If the lower end of the bearish wedge is broken the market could retrace to the next key support level. The key support levels below the bullish channel low are at 1.8976 and 1.9040.

How would you trade the GBPAUD today?

I hope this fundamental and technical GBPAUD analysis helps you to make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

DISCLAIMER: TIO Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.