Gold Technical Analysis | Bearish weekly candle hints at market reversal

BY Janne Muta

|December 12, 2023Gold Technical Analysis - As traders wait for the release of the Consumer Price Index (CPI) data for November today, the focus remains on understanding the current inflation trajectory and the Fed rate cut expectations. The CPI report is crucial for all markets priced in USD.

Following October's figures where the Core CPI year-over-year remained steady at 4% the Core CPI for November is expected to mirror this trend. US inflation is expected to remain persistent yet stable. A slight increase in month-over-month Core CPI is forecasted at 0.3% indicating ongoing, albeit moderated, price pressures.

Tomorrow's Producer Price Index (PPI) release will provide further insights into wholesale price changes, which could signal future consumer price trends. October's PPI data showed a 0.5% month-over-month decline, largely driven by decreases in goods prices, including a notable drop in gasoline costs. This could suggest a potential softening in future consumer prices.

Moreover, the Federal Reserve's rate decision, also due tomorrow, is highly anticipated. The market widely expects no change in rates but traders will be keenly watching the Fed's press conference for indications of future monetary policy, especially regarding the expectations for the first rate cut. Currently, Fed Funds Futures pricing indicates an 80.2% probability of the first rate cut happening in May 2024.

Summary of This Gold Technical Analysis Report:

- After failing to attract new demand at its all-time high levels, gold formed a bearish rejection candle on the weekly chart and is currently trading below it. These bearish indications could lead to the market trading down to 1919 or so.

- Although moving averages based on gold technical analysis still suggest that the market is bullish, the strong rejection candle created on the weekly chart suggests otherwise. The nearest daily timeframe resistance levels are at 2009 and 2040.

Read the full gold technical analysis report below.

Gold Technical Analysis

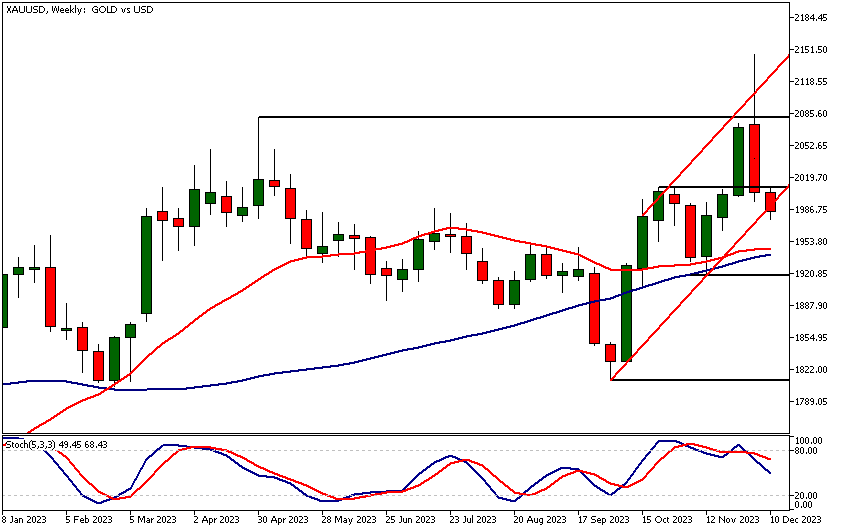

Weekly Gold Technical Analysis

After failing to attract new demand at its all-time high levels, gold formed a bearish rejection candle on the weekly chart and is currently trading below it. These bearish indications could lead to the market trading down to 1919 or so.

Gold technical analysis suggests that if the market can't move back inside the channel and sustain levels above 2009, we could see gold trading down to the 1919 support level, and then possibly to around 1850 as an extension.

The latter price level is derived using a measured move target based on the width of the bull channel in making the projection. Alternatively, if the market can rally above the 2009 resistance level and attract buying above it, gold might trade up to 2040.

Daily Gold Technical Analysis

The daily chart reveals that gold has already broken below the ascending price channel. Yesterday, gold closed well below the channel's low, suggesting there could be further weakness ahead. The 1919 level is the nearest major support level in the daily chart.

Now that the market is trading below the ascending trend channel, the likelihood of gold trading down to this level has increased. Although moving averages based on gold technical analysis still suggest that the market is bullish, the strong rejection candle created on the weekly chart suggests otherwise. The nearest daily timeframe resistance levels are at 2009 and 2040.

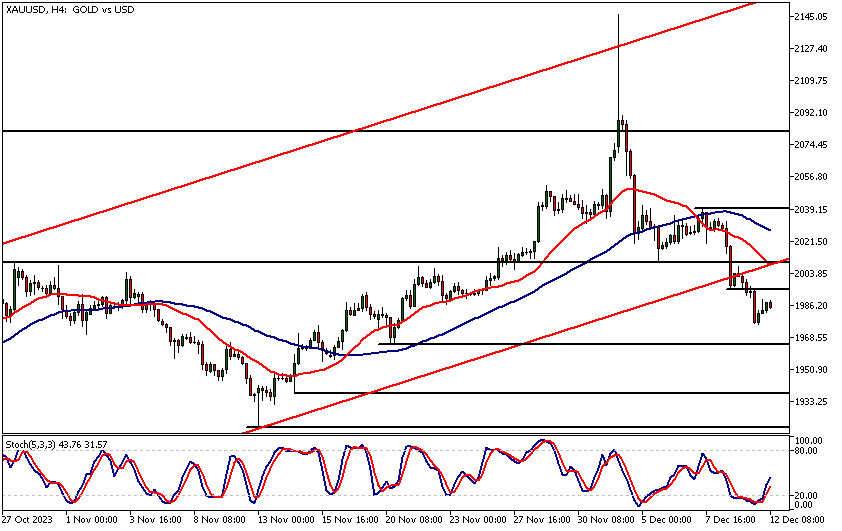

Gold Technical Analysis, 4h

In the 4-hour chart, gold is creating lower lows and lower highs. The nearest minor resistance level is at 1994.65. In this timeframe, the market remains bearish below this level and could trade down to 1966.

Alternatively, the market may try to rally above the 1994.65 resistance level, but our gold technical analysis shows that the market would immediately face challenges at the 2009 level, where the ascending channel's low and the 20-period moving average coincide with the 2009 resistance level.

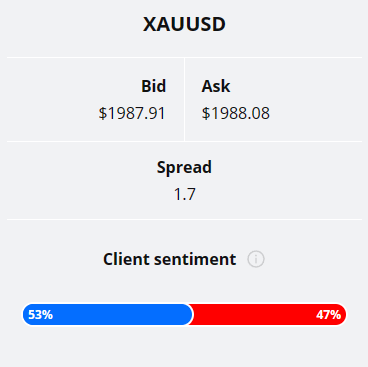

Client sentiment analysis

TIOmarkets client sentiment analysis doesn't provide clear indication on trader sentiment on Gold as clients are fairly evenly divided between bullish and bearish camps with 53% of clients holding long positions and 47% holding short positions in the market.

Please remember that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

The next key risk events impacting this market:

- USD - Core CPI

- USD - CPI

- USD - PPI and Core PPI

- USD - Federal Funds Rate

- USD - FOMC Economic Projections

- USD - FOMC Statement

- USD - FOMC Press Conference

- USD - Retail Sales and Core Retail Sales

- USD - Unemployment Claims

- USD - Empire State Manufacturing Index

- USD - Industrial Production

- USD - Flash Manufacturing PMI

- USD - Flash Services PMI

Potential Gold Market Moves

Gold technical analysis suggests that if the market can't move back inside the channel and sustain levels above 2009, we could see gold trading down to the 1919 support level, and then possibly to around 1850 as an extension. Alternatively, if the market can rally above the 2009 resistance level and attract buying above it, gold might trade up to 2040.

How Would You Trade Gold Today?

I hope this Gold technical analysis helps you to make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

DISCLAIMER: TIO Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.