Nasdaq 100 Technical Analysis | USD Strength Weighs Technology Stocks

BY Janne Muta

|December 5, 2023Nasdaq 100 Technical Analysis - Yesterday US equities showed some weakness after a month of unusually strong performance. The dip in stocks was attributed to a rise in bond yields which had a negative impact on stocks, especially in the tech sector. However, it seems that price swing in Nasdaq have a higher negative correlation with the USD Index.

The Nasdaq Composite slid by 0.8% while the S&P 500 traded lower by 0.5%, and the Dow industrials remained almost unchanged at -0.1%. Behind the weakness in the technology index Nasdaq were stock price declines in tech giants like Nvidia, Microsoft, and Amazon. Despite this, there was still optimism in the market, as the low liquidity Russell 2000 small-cap stock index closed 1% higher.

Today significant economic data will be released, including the ISM services PMI survey and the JOLTS report for October. The latter offers insights into job openings. Although there was an unexpected rise in job openings in August and September, the overall trend throughout the year had been a decline.

Yesterday's US factory orders data showed a substantial 3.6% decline in orders for October, the largest drop since April 2020. This decline was worse than expected and was attributed to challenges posed by high interest rates and inflation in the industrial sector.

Summary of This Nasdaq 100 Technical Analysis Report:

- Following this loss of momentum, the market traded lower yesterday and today, breaching last week's low at 15,823. This bearish development could potentially lead to further declines, possibly pushing the market down to 15,540. Below this level, the nearest key weekly support area can be found between 15,210 and 15,336, while the closest key weekly resistance level remains last week's high at 16,165.

- If the weakness persists, we could anticipate a move down to 15,540. Conversely, if the USD index were to decline, and the NASDAQ turned more bullish, we might see a move up to 16,960 and then possibly to 16,165 on extension. However, based on both weekly and daily NASDAQ 100 technical analyses, the immediate upside potential may be more limited compared to the downside.

Read the full Nasdaq 100 technical analysis report below.

Nasdaq 100 Technical Analysis

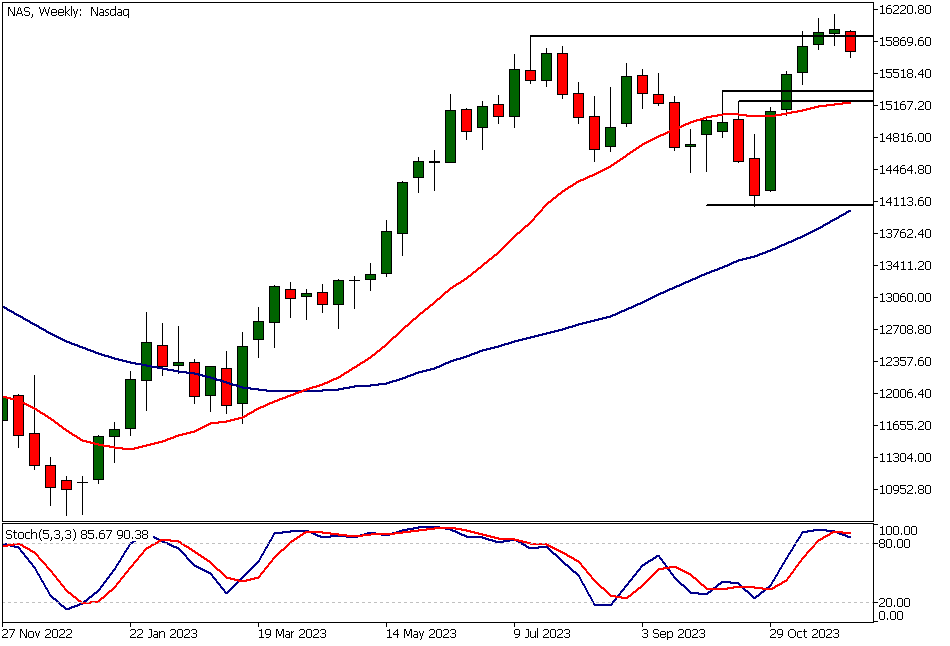

Weekly Nasdaq 100 Technical Analysis

The NASDAQ 100 index CFD experienced a remarkable 15% rally over a span of 5 weeks, surpassing even the July high at 15,931. However, the market struggled to draw in buyers beyond this crucial market structure level, resulting in a narrow-range candle forming on the weekly chart last week.

Following this loss of momentum, the market traded lower yesterday and today, breaching last week's low at 15,823. This bearish development could potentially lead to further declines, possibly pushing the market down to 15,540. Below this level, the nearest key weekly support area can be found between 15,210 and 15,336, while the closest key weekly resistance level remains last week's high at 16,165.

From the perspective of indicator-based NASDAQ 100 technical analysis, the market remains in an uptrend, with both moving averages trending upwards. However, it is currently overbought, with the stochastic oscillator deeply entrenched in the overbought territory.

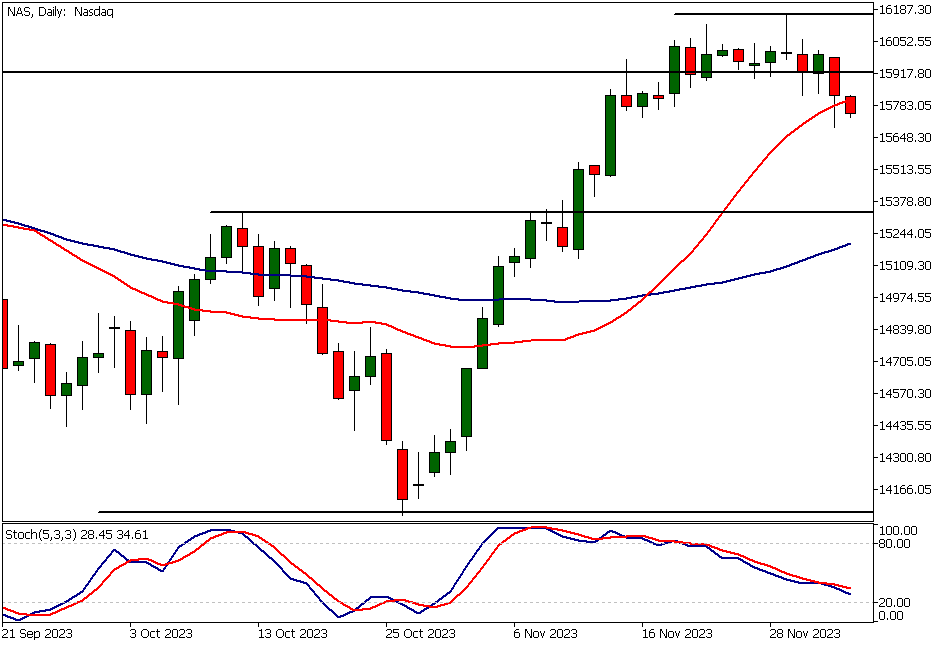

Daily Nasdaq 100 Technical Analysis

Since forming a bearish rejection candle on November 29th, the NASDAQ has displayed weakness and traded lower. Notably, this decline coincided with the strengthening of the USD index on the very same day, highlighting the sensitivity of the NASDAQ to movements in the US dollar.

It's worth noting that the strong rally in technology stocks, which began on November 1st, coincided with the USD index's peak and subsequent decline. Therefore, traders should closely monitor the interaction between these two markets.

Potential target levels

If the weakness persists, we could anticipate a move down to 15,540. Conversely, if the USD index were to decline, and the NASDAQ turned more bullish, we might see a move up to 16,960 and then possibly to 16,165 on extension. However, based on both weekly and daily NASDAQ 100 technical analyses, the immediate upside potential may be more limited compared to the downside.

Based on indicator-driven NASDAQ 100 technical analysis, the market remains medium to long-term bullish, with both moving averages pointing upwards and the 20-period moving average positioned above the slower 50-period moving average.

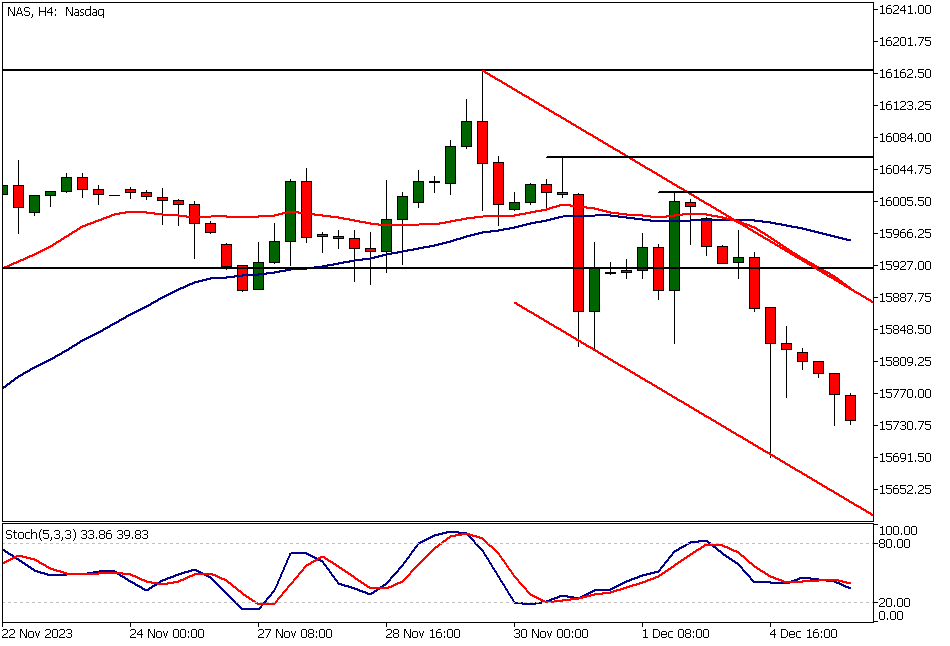

Nasdaq 100 Technical Analysis, 4h Chart

On the 4-hour chart, NASDAQ is currently trading lower within a descending trend channel. The 20-period moving average closely aligns with the upper boundary of the bearish channel, currently situated at 15,890.

Key resistance levels

In this time frame, the nearest key resistance levels can be identified at 16,016 and 16,060. This suggests that the market maintains a bearish outlook below these key resistance levels. Conversely, if the market manages to breach the 16,060 level and attract increased buying interest, it could potentially test the high at 16,165.

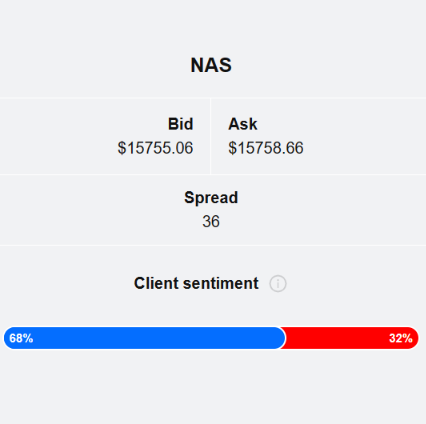

A majority of TIOmarkets' clients are bullish on Nasdaq 100 with 68% holding long positions while 32% hold short positions.

Please remember that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

The next key risk events for this market

- USD - ISM Services PMI

- USD - JOLTS Job Openings

- USD - ADP Non-Farm Employment Change

- USD - Unemployment Claims

- USD - Average Hourly Earnings

- USD - Non-Farm Employment Change

- USD - Unemployment Rate

- USD - Prelim UoM Consumer Sentiment

- USD - Prelim UoM Inflation Expectations

Potential Nasdaq 100 Market Moves

If the weakness persists, we could anticipate a move down to 15,540. Conversely, if the USD index were to decline, and the NASDAQ turned more bullish, we might see a move up to 16,960 and then possibly to 16,165 on extension.

However, based on both weekly and daily NASDAQ 100 technical analysis, the immediate upside potential may be more limited compared to the downside.

How would you trade the Nasdaq 100 today?

I hope this Nasdaq 100 technical analysis helps you to make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

DISCLAIMER: TIO Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.