SNB bails out Credit Suisse

BY Janne Muta

|March 16, 2023The fears related to bank shares created volatility, not only in bank stocks but also in bonds and commodities as investors bought US T-bonds, gold, and the dollar. In Europe, the Credit Suisse (CS) crisis pushed the yields and EUR sharply lower as investors sought safety amidst the CS and other bank shares falling. When Swiss regulators (SNB) offered to provide €50 bn of liquidity financing to CS banks shares that had been down 34.6% started to recover together with the other European bank stocks. The move supported the US equity markets too. WTI Crude dived too as oil traders were concerned about global growth. Commodity currencies dived for the same reason.

Today’s main risk event is the ECB rate decision. The market expectation has been that the ECB would hike by 50 bp. With the markets as jittery as they are a 50 bp hike looks highly unlikely. Instead, it’s more likely not to rock the boat under the current circumstances. However, as always we will trade what we see (price action) and concentrate on good timing and professional risk management. Markets will do what they do and our job as traders is to take a trade when we have an edge.

DJ remains bearish below the 32 280 – 32 240 range

DJ made a new low for the week and remains bearish below the 32 280 – 32 420 range. A decisive rally above the range would probably allow the market to trade to the 32 650 or so.

NAS rallied to resistance

Nasdaq created a higher swing low in the 8h chart that led to a continuation in the rally. NAS is now approaching a technical confluence area where a downward-sloping trend line and some recent peaks create resistance. If NAS can push decisively through the 12 340 – 12 370 range there’s a good chance of market trading to 12 450 or so first and then to 12 700 on extension if the upside momentum doesn’t fade. A failure to penetrate the confluence area probably leads to a corrective move to 12 200 or so.

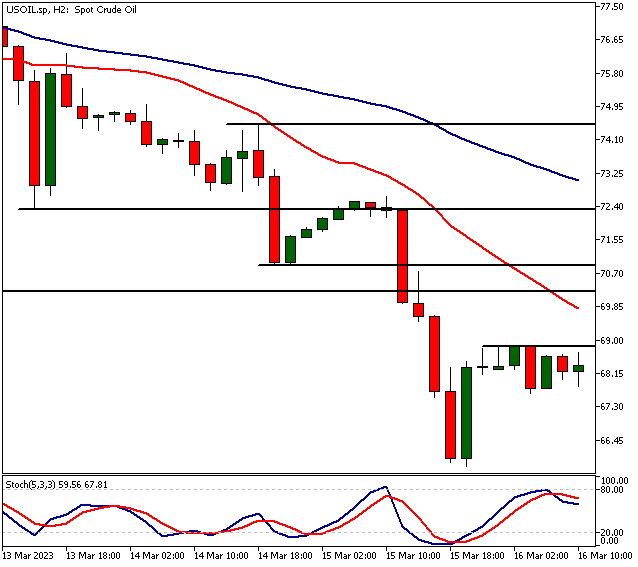

USOIL is bearish below 70.24

USOIL traded through the September 2022 low (70.24) so the market is now bearish below this level. As long as there’s no decisive rally above the 70.24 resistance level the market is likely to trade lower and possibly to 62.50 or so. Note that the nearest two-hour chart S&R level is at 68.90. Alternatively, if USOIL managed to rally above 70.24 the 72.50 resistance level would probably come into play.

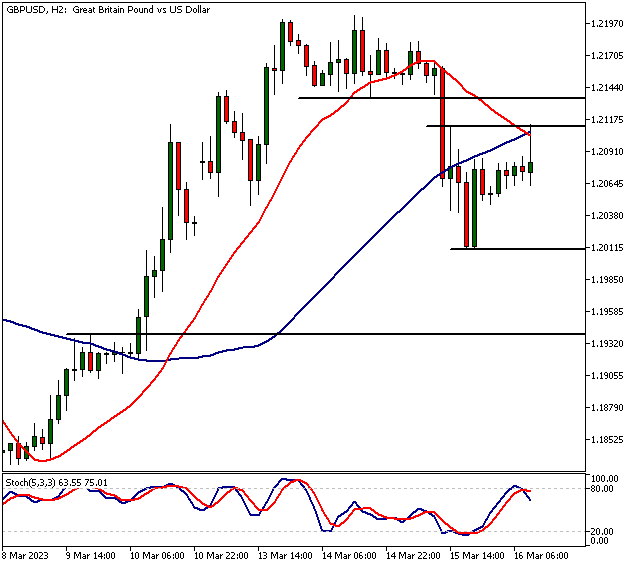

GBPUSD is bearish below 1.2114

GBPUSD turned bearish after the 1.2135 level failed to support the market. The market is now bearish below 1.2114 and thus likely to trade again to yesterday’s lows if the 1.2114 isn’t penetrated. Alternatively, a rally above the 1.2114 level could take GBPUSD to 1.2135.

EURUSD dropped with bonds on Credit Suisse fears

EURUSD range breakout failed yesterday and the pair dropped right back to the range low (1.0533) as the Credit Suisse debacle boosted default fears in the bank. This rallied the European bond markets sending yields and EUR sharply lower. The market has now bounced higher from the range low and the next key resistance area is at 1.0670 – 1.0690.

The Next Main Risk Events

- USD Philly Fed Manufacturing Index

- USD Unemployment Claims

- EUR Main Refinancing Rate

- EUR Monetary Policy Statement

- EUR ECB Press Conference

- USD Prelim UoM Consumer Sentiment

- USD Prelim UoM Inflation Expectations

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets.com

DISCLAIMER TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval. FX and CFDs are leveraged products. They are not suitable for every investor, as they carry a high risk of losing your capital. Please ensure you fully understand the risks involved. All the prices in this report are CFD prices based on price charts provided by TIOmarkets unless otherwise stated.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.