The crisis could force the Fed’s hand

BY Janne Muta

|March 14, 2023Yesterday’s slower pace of decline in DJ and an up day in Nasdaq suggests that there’s some optimism coming into the market as investors hope that the threat of a more widespread banking crisis could slow the pace of monetary tightening. According to the CME group data, the fed funds futures traders now price in a zero probability of a 50 bp hike for next week while just a week ago the probability was a couple of ticks under 70%.

In the past rate hiking cycles have led to substantial problems that eventually forced the Fed to change its plans. The subprime crisis in 2007 and 2008 led to rate cuts and so did the 1998 collapse of the Long-Term Capital Management hedge fund. Then there was the 1994 Mexican peso devaluation that forced the Fed to abandon aggressive rate hikes.

My take on the situation is that the Fed will be likely to signal a more cautious approach to monetary tightening in next week’s meeting so that it can monitor how the ripples from the SVB crisis spread.

If the current measures taken by the authorities calm the markets the Fed will no doubt return their focus to inflation and continue rate hikes later on. Currently, the markets believe there’s a 56% probability for a 25bp hike next week (up from 30.2% a week ago).

DJ remains bearish below the 32 237

DJ remains bearish below 32 237. Yesterday’s decline as measured from the open to the close was less than in the preceding days. The market bounced from the low and closed above the 31 713 support level created in November last year. If the downward momentum continues the market fails to rally above 32 237 it’s likely that the market moves to 31 300. Above the 31 173 level, the market probably moves to 32 400 or so. This week’s biggest risk event, the US CPI release is scheduled for today at 12:30 pm GMT.

NAS is bearish below a key price range

NAS is bearish below the 11924 - 12 096 range. If this area can be penetrated we’ll probably see a rally to 12 200. Below the range, the market is likely to trade down to 11 700.

DAX is bearish below 15 147

DAX is bearish below 15 147 and if there’s no decisive rally above the level the market probably trades to 14 660 or so. Above the 15 147 level, we might see a move to 15 350.

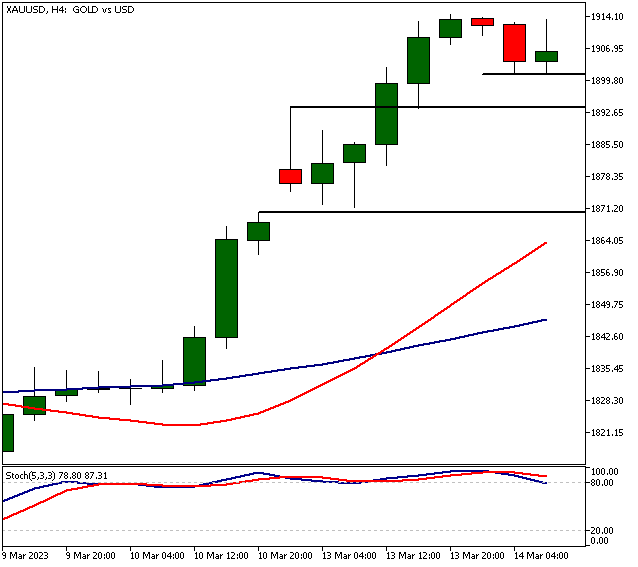

Gold is trading near February highs

Gold is bullish above 1901.50 but it’s trading near the February highs which is a risk for the bulls. If the level holds the market could trade to 1940 but if the level (1901.50) breaks the market probably tests 1894 and then 1860 if the bearishness continues.

The Next Main Risk Events

- GBP Claimant Count Change

- GBP Average Earnings Index 3m/y

- USD CPI and Core CPI

- GBP Annual Budget Release

- USD Core PPI m/m

- USD Core Retail Sales m/m

- USD Empire State Manufacturing Index

- USD PPI m/m

- USD Retail Sales m/m

- NZD GDP q/q

- AUD Employment Change

- AUD Unemployment Rate

- USD Philly Fed Manufacturing Index

- USD Unemployment Claims

- EUR Main Refinancing Rate

- EUR Monetary Policy Statement

- EUR ECB Press Conference

- USD Prelim UoM Consumer Sentiment

- USD Prelim UoM Inflation Expectations

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets.com

DISCLAIMER TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval. FX and CFDs are leveraged products. They are not suitable for every investor, as they carry a high risk of losing your capital. Please ensure you fully understand the risks involved. All the prices in this report are CFD prices based on price charts provided by TIOmarkets unless otherwise stated.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.