USDCHF Aanlysis | Fed Confident in Inflation Moderation

BY Janne Muta

|December 4, 2023USDCHF Analysis - In his recent speech at Spelman College, Federal Reserve Chair Jerome Powell emphasized a balanced approach to monetary policy. Powell noted that the risk of excessively cooling the economy with high interest rates is now as concerning as the risk of inadequately raising rates to control inflation. This stance suggests a shift towards a more measured and possibly dovish approach.

Moreover, Powell's observation that recent inflation measures are approaching the Fed's 2% target implies that the current restrictive monetary policy might be effectively moderating inflation. His optimistic tone about the adequacy of the current policy rate, coupled with a readiness to adjust based on economic data, further highlighted a dovish tilt in the Fed's approach.

As a result, Federal Funds Futures are currently pricing in five rate cuts, each being 25 basis points, for the coming year. The first cut is now anticipated in March, with futures indicating a 59.3% probability of a rate reduction. If the futures market's predictions hold true, the Federal Reserve's target range by the end of 2024 will be at 4%.

As per today's CPI release, Switzerland's annual inflation rate fell to 1.4% in November, the lowest since October 2021. This decrease was observed across several categories. The month-over-month Consumer Price Index (CPI) declined by 0.2%, a larger drop than the anticipated 0.1% and a reversal from the 0.1% increase in October. The core inflation rate, excluding volatile items, also decreased to 1.4% from 1.5%.

The Swiss National Bank maintained its benchmark policy rate at 1.75% during its September 2023 meeting, stating that the significant tightening of monetary policy over recent quarters is countering the remaining inflationary pressure. However, policymakers noted that further tightening of monetary policy may become necessary to ensure price stability over the medium term. They will closely monitor inflation developments in the coming months.

Summary of This USDCHF Analysis Report:

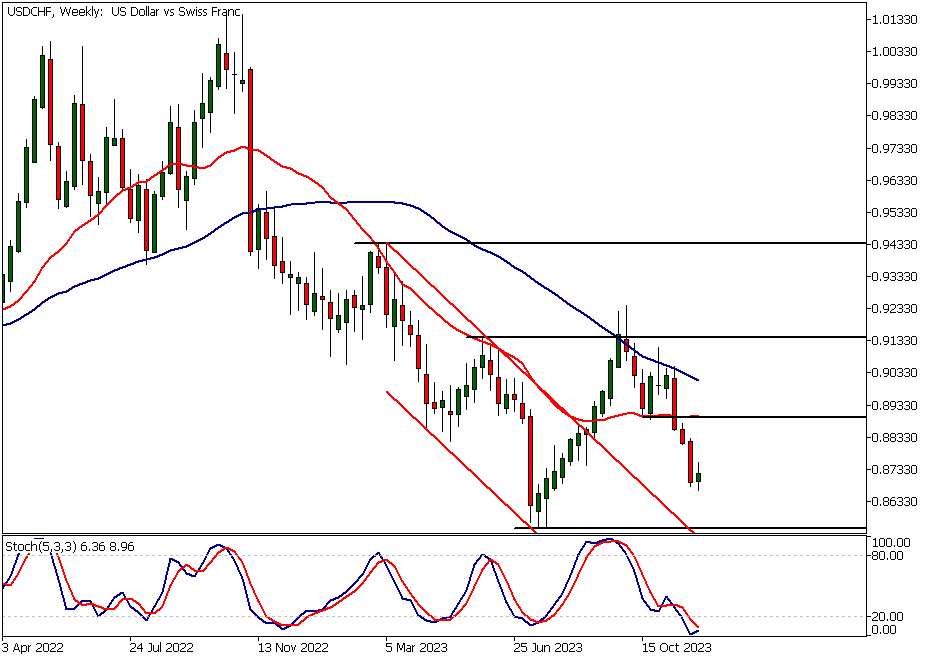

- The stochastic oscillator is in the oversold area, and the moving averages are bearish, with the 20-period moving average positioned below the 50-period SMA. This indicates that the market is currently bearish according to our USDCHF analysis.

- On the daily chart, USDCHF is trading close to the lower boundary of a descending trend channel, with the moving averages indicating a downward trajectory. For a counter-trend rally to take place the market needs to break above the 0.8768 resistance level. Otherwise the market remains in downtrend.

- Powell's observation that recent inflation measures are approaching the Fed's 2% target implies that the current restrictive monetary policy might be effectively moderating inflation. As a result traders are now betting the first rate cut could happen in March.

Read the full USDCHF analysis report below.

USDCHF Analysis

Weekly USDCHF analysis

The stochastic oscillator is in the oversold area, and the moving averages are bearish, with the 20-period moving average positioned below the 50-period SMA. This indicates that the market is currently bearish according to our USDCHF analysis.

Major support level only 1.5% away

Note, however, that the USDCHF has been trading lower for three consecutive weeks, bringing the market within 1.5% of a major support level, the July low at 0.8554. Although the market remains bearish, it could soon reach levels where the immediate downside may become limited.

Daily USDCHF analysis

On the daily chart, USDCHF is trading close to the lower boundary of a descending trend channel, with the moving averages indicating a downward trajectory. However, the stochastic oscillator is rising from the oversold area.

Divergence indication

This divergence suggests that while the market is trending lower, it could be oversold at current levels. This could lead to a counter-trend rally. However, for the rally to take place the market needs to break above the 0.8768 resistance level. USDCHF analysis indicates that above this level, a rally up to 0.8820 could occur. Alternatively, a move down to 0.8640 could be likely.

USDCHF analysis, 2h Chart

The 2-hour chart shows increased market volatility in recent days, which might indicate that the downtrend is maturing. These are just early indications and as such should not be taken as a prediction that the market is now likely to reverse the downtrend and move higher. The moving averages are still pointing lower, and the market trades below the 50-period moving average.

Breakout needed for a sustained rally

But, if there is a decisive rally above the 0.8640 resistance level, a more sustained counter-trend rally could be possible. If the market rallies above this level, follow the price action in minor timeframes to determine if a sustained uptrend can form. Otherwise, USDCHF analysis shows, the risk of the market trending lower remains considerable.

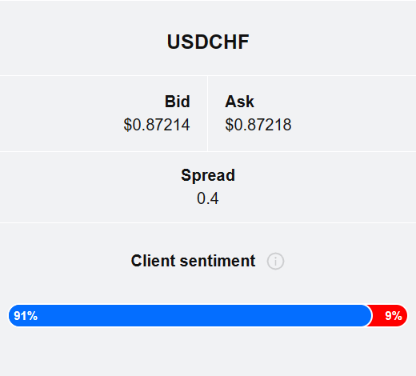

Client sentiment analysis

TIOmarkets' clients are extremely bullish on USDCHF with 91% of them currently holding long positions in the market, while 9% of them are short the market.

Please remember that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

The key risk events impacting this market today

- USD - ISM Services PMI

- USD - JOLTS Job Openings

- USD - ADP Non-Farm Employment Change

- CHF - Foreign Currency Reserves

- USD - Unemployment Claims

- USD - Average Hourly Earnings

- USD - Non-Farm Employment Change

- USD - Unemployment Rate

- USD - Prelim UoM Consumer Sentiment

- USD - Prelim UoM Inflation Expectations

Potential USDCHF Market Moves

On the daily chart, USDCHF is trading close to the lower boundary of a descending trend channel, with the moving averages indicating a downward trajectory. However, the stochastic oscillator is rising from the oversold area.

This divergence suggests that while the market is trending lower, it could be oversold at current levels. This could lead to a counter-trend rally. For a more decisive rally, the market needs to break above the 0.8768 resistance level. Above this level, a rally up to 0.8820 could occur. Alternatively, a move down to 0.8640 could be likely.

How would you trade the USDCHF today?

I hope this fundamental and USDCHF analysis helps you to make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

DISCLAIMER: TIO Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.