Forex Nano Accounts: A Quick Start Guide To Nano Lot Trading

BY TIOmarkets

|junio 21, 2024Forex nano accounts allow you to trade from as low as 0.001 lots or 100 units of currency. This account type and lot size is ideal for low risk trading, small investments or more precise risk management strategies.

Forex nano accounts have emerged as a game-changer for both novice and experienced traders for these reasons. They are an attractive option for beginners looking to dip their toes into the forex market with the smallest investment and to bypass the demo account completely.

In this comprehensive guide, we will explore the forex nano account and nano lot trading as well as provide you with the knowledge needed to get started. So keep reading to discover the key features and benefits of forex nano accounts.

Let’s get started.

What are Forex Nano Accounts?

Forex nano accounts are a type of forex trading account that allow traders to participate in the foreign exchange market with minimal risk and with a minimal investment. These accounts are primarily designed to provide a low-risk environment for traders to learn, practice and gain experience with the smallest lot sizes possible.

A forex nano account is characterized by its extremely small account size, typically ranging from a $5 to a $50 balance. But despite the minuscule investment, the account type's main feature reflects the ability to trade proportionally small lot sizes.

Forex nano accounts allow nano and micro lot trading, which are mere fractions of a standard lot. For instance, a nano lot (0.001) is 1/1000th of a standard lot, whereas a micro lot is 1/100th of a standard lot. Nano lots represent 100 units of currency while micro lots represent 1000 units of currency. Let's see how this compares to a standard lot.

| Standard lot (1.0) | Micro lot (0.01) | Nano lot (0.001) |

| 100,000 units of currency | 1,000 units of currency | 100 units of currency |

When trading with such small lot sizes, like nano lots or micro lots on a micro account, the potential profits and losses are significantly minimized. Making forex nano accounts an ideal option for risk-averse traders or beginners. To help illustrate this, the table below compares how much a trader could potentially profit or lose when trading standard lots or nano lots, for the same price movement.

| Price change in pips | Trading standard lots | Trading nano lots |

| 100 | $1,000 | $1 |

| 50 | $500 | $0.50 |

| 10 | $100 | $0.10 |

Apart from the profit or loss being minimized, nano lots offer immense flexibility in terms of risk management too. Allowing traders to experiment with different strategies and controlling the lot size down to 100 units of currency.

How Forex Nano Accounts Work

Trading on forex nano accounts operates similarly to a cent, micro, mini or standard forex account, but on a reduced scale. Traders can still buy and sell currency pairs, using leverage, but with much smaller volumes.

Here is an example.

Example Nano Lot Trade and Potential Outcomes

Let's consider an example trade on a forex nano account:

- Account size: $10

- Leverage: 1:500

- Lot size: 0.001 or 100 units of the base currency

- Margin requirement: $0.20

- Trade: Buy EUR/USD at 1.1800

- Stop-loss: 50 pips (at 1.1750)

- Take-profit: 100 pips (at 1.1900)

If the trade is successful and the EUR/USD rises to 1.1900, the profit would be approximately $1 (based on the nano lot size of 0.001). However, if the trade is unsuccessful and the stop-loss is triggered at 1.1750, the loss would be approximately $0.50.

While the potential profits and losses may seem insignificant, nano accounts allow traders to gain real world experience with some skin in the game and develop their skills by risking very small amounts.

Advantages of Trading on a Forex Nano Account

- The best alternative to demo trading

- Great for risk-averse traders

- Nano lots minimizes exposure to losses

- Start with a small investment

- Control lot size with greater precision

Forex nano accounts offer a multitude of benefits that cater to both risk-averse traders and those seeking more precision with risk management. With nano accounts, traders can participate in the forex market with a significantly reduced initial deposit, minimizing their exposure to potential losses. This feature makes nano accounts an attractive choice for individuals who are hesitant to commit substantial funds, or want to try forex trading for real and bypass the demo account.

Furthermore, forex nano accounts provide an unparalleled level of accessibility for beginners to trade with real money. Some traders might face barriers to entry due to funding or have a fear of incurring significant losses. With nano accounts and nano lot trading, these obstacles are effectively mitigated, empowering aspiring traders to embark on their trading journey with some small investment. The minimal investment required opens up a world of opportunities, enabling beginners to develop their skills and strategies in a low-risk environment.

For experienced traders, forex nano lots offer an opportunity to explore and test new trading strategies with minuscule amounts, or control risk with greater precision. These accounts allow seasoned traders to experiment with different approaches and the greater lot size flexibility means risk can be controlled down to the last cent ($0.01 per pip).

Disadvantages of Nano Lot Trading

- Significantly limits profit potential

While trading with nano lots on a nano account is beneficial in some cases, it also comes with its own set of disadvantages. The very nature of nano accounts are intended for trading with the smallest lot sizes possible, so this will also significantly limit any potential to profit. Trading in such small lot sizes can make it very challenging to achieve any worthwhile gains. While traders looking to scale up to trade larger volumes may find nano accounts very restrictive. Especially when small deposits are involved and using high levels of leverage, which poses further risks in and of itself.

Overall, don’t expect to make any significant profits from trading nano lots, this is reserved for the larger lot sizes.

Opening a Forex Nano Account

- Available on the MT5 trading platform

- With USD base currency

If you are looking for a Forex nano account, you can get started with nano lot trading with TIOmarkets on the MT5 trading platform with a USD denominated account base currency. Just follow these simple steps to get started.

1. Register

Register your account with TIOmarkets, it only takes a few minutes and this will take you to your secure client portal.

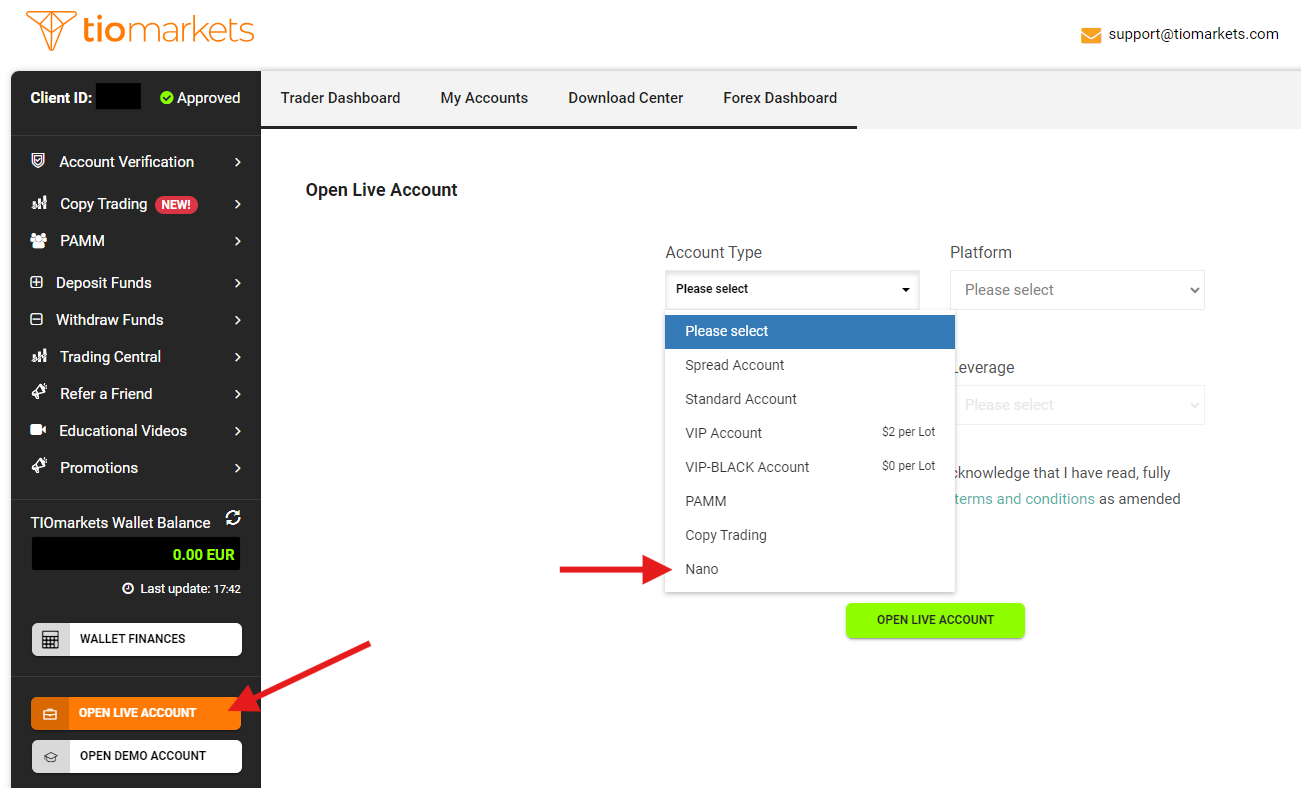

2. Create nano account

Create your forex nano account in your secure client area, choose MT5 as the trading platform and USD as the account base currency. The login credentials will be sent to you by email.

3. Download the trading platform

Download the MT5 trading platform to your computer or mobile phone. The nano account is currently only available on Metatrader 5.

4. Deposit funds

Go to deposit, select your deposit method and enter your preferred amount. You can start trading with TIOmarkets with a very small amount.

5. Transfer funds from your wallet to your trading account

Once you have made a successful deposit, go to manage funds and transfer the funds from your TIOmarkets wallet to the trading account created in the previous step.

6. Log in to the trading platform

Log in to the MT5 trading platform with the credentials sent to you in the previous step. Once logged in, you should notice your balance reflects your deposit.

Now you are ready to start trading on your forex nano account.

Start Your Nano Lot trading Journey With TIOmarkets

TIOmarkets is a leading online trading platform that provides traders with seamless access to the global financial markets. You can trade over 300 instruments across 5 markets, including Forex, indices, stocks, and commodities with leverage. Our platform offers forex nano accounts, advanced charting and real-time market data.

Start trading nano lots on MT5 with TIOmarkets, register your trading account

Learn about other forex trading accounts

- Forex cent account

- Forex micro account

- Forex mini account

- Forex raw spread vs standard account

- Forex low fee trading account

- Forex copy trading account

- Forex demo account

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & Countries included in the OFAC sanction list. The Company holds the right to alter the aforementioned list of countries at its own discretion.

TIOmarkets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Join us on social media

Behind every blog post lies the combined experience of the people working at TIOmarkets. We are a team of dedicated industry professionals and financial markets enthusiasts committed to providing you with trading education and financial markets commentary. Our goal is to help empower you with the knowledge you need to trade in the markets effectively.

Related Posts