How To Calculate Lot Size For Gold

BY Chris Andreou

|junio 22, 2022How to calculate lot size for Gold on the MT4 and MT5 trading platforms can be a little confusing. But when you are trading, lot size is one important factor that must be considered.

I’ve often been asked by many traders that have just started trading on the platform, what’s the lot size for gold? or how much is a contract of gold worth? And it’s a good question, because this is mandatory knowledge to ensure that you aren’t risking too much or too little when placing the trade.

In this article, we will be looking at some common lot sizes for gold, their pip values and how to calculate lot size for gold trading.

So keep reading until the end to learn all about it.

How To Calculate Lot Size For Gold

There are plenty of different ways to calculate the lot size for gold when trading. Some traders use the average true range to determine price volatility, others measure the distance in pips to the next support or resistance area. In combination with this, they buy or sell the appropriate lot size given their risk.

Whichever way you go about it, it is important that you understand what the lot size is and how the lot size determines the pip value. You must know this before placing a trade so you can select the correct volume.

What is the lot size for gold?

The lot size for gold is the amount of gold you will be buying or selling and is usually expressed in troy ounces. One standard lot (1.0) on TIOmarkets MT4 or MT5 trading platform represents 100 ounces of gold. One mini lot (0.1) represents one tenth of a lot, or 10 ounces of gold. One micro lot (0.01) represents one hundredth of a standard lot or 1 ounce of gold.

| Contract size | MT4 / 5 volume | Ounces of gold | PIP value |

| Standard lot | 1.0 | 100 | $10 |

| Mini lot | 0.1 | 10 | $1 |

| Micro lot | 0.01 | 1 | $0.10 |

The lot size for gold can vary between brokers

It is important to check the contract specification on your platform to determine whether it is the same for you. As the lot size for gold and the minimum trade volume between brokers can vary. TIOmarkets allows you to trade from 1 ounce of gold so for every dollar that the price moves up or down, you will profit or lose the same.

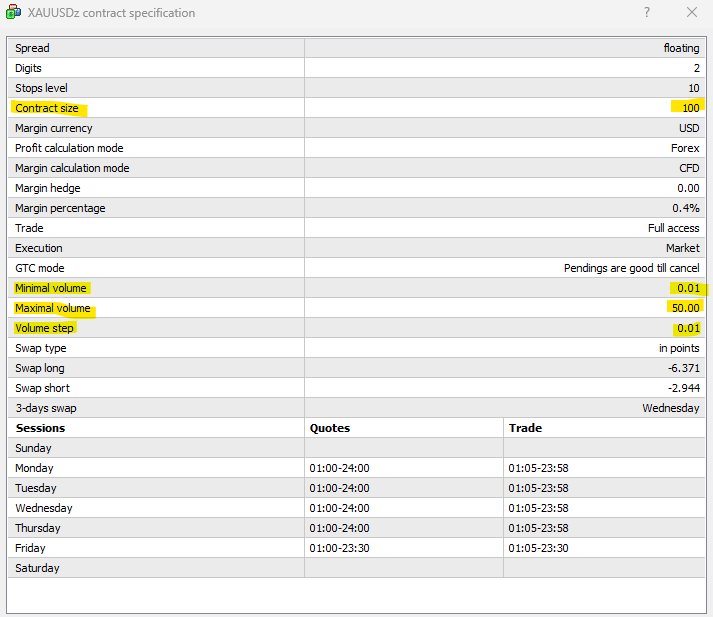

Understanding the contract specification for gold

The specific details of how to calculate the lot sizes mentioned above can be found in the contract specification. You can find it from within the MT4 or MT5 trading platform. Just right-click on the symbol for gold (XAUUSD) in the market watch window and select “specification” from the pop-up menu that appears.

I’ve copied and pasted it below and highlighted some sections that are particularly important.

As you can see from the contract specification above, the contract size for gold is 100 ounces. Which means that whenever you select 1.0 lots in the volume field on the MT4 or MT5 trading platform, you will be buying or selling 100 ounces of gold.

Further down the contract specification sheet, you will see the minimum volume, maximum volume and volume step information. The former two are self explanatory, they let you know what the minimum and maximum lot sizes are. The latter, volume step tells you the minimum increment or decrement in the lot size you can enter..

For example, the minimum volume is 0.01 lots, which is 1/100th of a standard lot (1.0). If 1.0 lots is equal to 100 ounces of gold, then a volume of 0.01 is one ounce. Therefore, the minimum lot size for gold on TIOmarkets trading platform is one ounce of gold.

The maximum lot size or volume for gold on TIOmarkets trading platform is 50 lots or 5,000 ounces of gold.

For the volume step, you can buy or sell in lot sizes from 0.01 lots, and in any multiple of one ounce. In other words, you can buy or sell 0.01 lots, 0.02 lots, 0.03 lots, and so on.

I hope this all makes sense so far.

How does lot size for gold affect pip value

As you have come to learn, the lot size for gold is the term used to describe the amount of gold that you are trading. It is directly related to and has a significant effect on the pip value. Which in turn, affects how much money you can potentially make or lose in the gold market.

As a rule, the smaller the lot size, the smaller the pip value and vice versa. This is due to the fact that with a smaller lot size, you are trading fewer ounces of gold. Because of this, your risk and profit potential will be less compared to trading larger lot sizes. So it goes without saying, with a larger lot size, you are trading more ounces of gold, your risk and profit potential will be more.

Now, I will show you how to calculate lot size for gold with this information when trading. Lets look at a couple of examples so you can better understand how to calculate lot size for gold.

How to calculate lot size for gold examples

When you start to trade gold, you need to think about how much you are prepared to risk on the trade. It is easier to work out the lot size you should be trading when you know how much risk and adverse price movement you can accept before stopping the trade.

For example, if you are willing to risk $100 and accept $100 as an adverse price movement in the price of gold, you can trade one ounce (0.01 lots) of gold. If you were to buy or sell two ounces (0.02 lots) of gold in this example, the same $100 per ounce price move would mean that you would lose twice the amount.

Let’s see how you would calculate the lot size for gold for this hypothetical scenario.

Gold is trading at $1,835.00 per ounce and you are prepared to risk $100. You have decided to put your stop loss 200 pips away (or $20 in the price of gold). Dividing $100 by $20 gives us a lot size of 5 ounces of gold, or 0.05 lots.

Here is the formula used to calculate the lot size of gold.

Amount to risk (in $) / distance of stop loss (in $) = number of ounces to trade.

Let’s look at another example.

Gold is trading at $1,850.00 per ounce and you are prepared to risk $250. The stop loss will be placed 350 pips away or $35 in the price of gold.

To calculate the lot size using the formula above, divide the amount to risk ($250) by 350 pips ($35) to get the number of ounces to trade. In this example, it would be 7.14 ounces. However, you can only trade in step volumes of 0.01 lots or in multiples of one ounce. So this would be rounded down to 7 ounces or 0.07 lots to not exceed the amount to risk. It’s as simple as that.

Are you ready to start trading gold? Keep reading to learn how to open your account.

How to open an account to start trading gold

The first thing you need to do is create a trading account. Follow these simple steps to register and download the trading platform to get started.

1. Register your profile

This only takes a few minutes, once you have gone through the process, you will be in your secure client area.

2. Create a demo or live trading account

Create your demo or live account from your secure client area and choose the MT4 or MT5 trading platform. The login credentials will be sent to your email.

3. Download the trading platform

From your secure client area, navigate to the download center and download the trading platform you selected in the previous step to your computer or smartphone.

4. Deposit funds

Now go to deposit or deposit funds, choose your deposit method and the amount that you want to deposit.

5. Transfer your funds to the trading platform

Once you have made a successful deposit, you now have to transfer your funds from your TIOmarkets wallet to your trading account. Go to manage funds to do this.

6. Log in to the trading platform and start trading

You’re done and ready to start trading gold (XAUUSD). log in to the trading platform and you should notice your balance reflects your deposit.

Why knowing the lot size for gold is important

The reason for knowing how to calculate lot size for gold trading is so important, because it directly affects how much you could potentially profit or lose. The higher your risk tolerance, the higher your lot size can be. The lower your risk tolerance the lower your lot size should be.

Lot sizes can vary from commodity to commodity and broker to broker. When trading gold, you first need to know how many ounces are in one lot. When you know this, understanding how to calculate lot size for gold will be easy. The contract specification provides these details.

The second step needed to calculate the lot size for gold when trading is to determine how much you want to risk in the gold market. When you know this you can easily work it out from the formula already outlined above.

Learn how to calculate lot size in other markets

- How to calculate lot size in forex

- How to calculate lot size for commodities

- How to calculate lot size for stocks

- How to calculate lot size for indices

- How to calculate lot size in crypto

Take your knowledge further with TIOmarkets

This is where education meets excellence, take your knowledge further with our suite of educational resources and sign up to our free forex trading course. Then put your knowledge to the test on a demo or live trading account.

With TIOmarkets, you can trade more than 300+ instruments in the forex, indices, stocks, commodities and futures markets, all with low fees and fast order execution speeds.

Whether you are a beginner or experienced traders, we are committed to providing you with 24/7 customer support and the tools you need to trade effectively.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & Countries included in the OFAC sanction list. The Company holds the right to alter the aforementioned list of countries at its own discretion.

TIOmarkets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Join us on social media

Experienced independent trader

Related Posts