Trade With A High Leverage Broker

BY Janne Muta

|junio 4, 2024TIOmarkets, a renowned high leverage broker, offers traders the opportunity to maximise their trading potential through its innovative leverage options. High leverage trading allows traders to control larger positions with a smaller trading account, significantly amplifying potential gains (and losses).

TIOmarkets stands out in the industry by providing an unlimited leverage account, enabling traders to operate without traditional margin requirements. This unique feature positions TIOmarkets as a preferred choice for skilled traders looking to exploit high leverage opportunities in the financial markets.

Key Takeaways of This Article

- Maximise Trading Potential with High Leverage: Discover how high leverage trading allows you to control larger positions with a smaller account, amplifying both potential gains and risks.

- High Leverage Broker Benefits: Learn about the unique features of the Unlimited Leverage Account, including increased position sizes, optimised capital utilisation, and enhanced trading flexibility.

- Essential Risk Management Strategies: Implement key risk management techniques like stop-loss orders, appropriate position sizing, and regular trade monitoring to protect your capital while trading with high leverage.

- Advantages and Drawbacks of High Leverage: Understand the pros and cons of high leverage trading, including maximised capital utilisation and increased trading flexibility, balanced against the risk of amplified losses and psychological pressure.

TIOmarkets Overview

TIOmarkets provides a comprehensive range of services tailored to the needs of both new and more experienced traders alike. The company offers several account types, including the Standard, VIP, and the innovative Unlimited Leverage account. Each account type comes with distinct features and leverage options, allowing traders to choose the one that best fits their trading strategies. The company also differentiates itself with competitive spreads, zero-commission trading options, and a robust trading platform, making it a top choice if you are seeking a reliable high leverage broker.

Account Types and Leverages

TIOmarkets offers a variety of account types designed to meet different trading needs, each with distinct leverage options.

- The Standard Account provides competitive spreads and flexible up to unlimited leverage, making it suitable for traders of all levels.

- The VIP Account, with tighter spreads than the standard account but a higher minimum deposit requirement, offers leverage up to 1:500.

- The standout offering is the Unlimited Leverage Account, a unique feature that sets TIOmarkets apart as a high leverage broker, allowing traders to operate without traditional margin constraints. This account type is particularly appealing for those looking to maximise their trading potential without being limited by margin requirements.

How Unlimited Leverage Works

How the Unlimited Leverage Account works is by allowing traders to maximise their trading capacity without traditional margin constraints. It enables the use of significantly higher leverage ratios compared to standard accounts.

Mechanics of Unlimited Leverage

The Unlimited Leverage Account at TIOmarkets operates differently from conventional accounts. Traditional leverage involves borrowing funds to increase the size of a trading position, which typically requires maintaining a margin – a portion of the trader's equity reserved to cover potential losses. In contrast, TIOmarkets' unlimited high leverage account eliminates this margin requirement, allowing traders to use their full account balance for trading without reserving a portion as a margin.

This structure offers several advantages

- Increased Position Sizes: With a high leverage broker you can control larger positions than what their account balance would normally allow.

- Optimised Capital Utilisation: All available funds can be used for trading, maximising the potential returns on investment.

- Enhanced Flexibility: Traders can take advantage of new high quality trade ideas or setups without being limited by margin calls or liquidations.

Practical Limits and Risk Management

- While a high leverage account offers significant benefits, it is essential to understand its practical limits and the associated risks. High leverage magnifies both potential gains and potential losses, making effective risk management crucial. Traders using a high leverage broker must employ strategies such as setting stop-loss orders, maintaining appropriate position sizes, and regularly monitoring their trades and market exposure to keep the total risk (across all positions) under control.

Example of Unlimited Leverage in Action

Consider a trader with a $1,000 account balance using a traditional 1:100 leverage ratio. He can control a position size of $100,000. With TIOmarkets’ unlimited leverage account, the same trader could control a much larger position, increasing his exposure and potential profits. TIOmarkets allows unlimited leverage up to a $999 account balance allowing responsible and skilled traders to substantially increase their trade sizes.

Note however, this also means that market fluctuations can lead to larger losses, underscoring the importance of robust risk management practices.

Pros and Cons of Unlimited Leverage

Understanding both significant advantages and potential drawbacks using a high leverage broker can help traders make informed decisions about their trading strategies.

Advantages

- Maximised Capital Utilisation: High leverage broker allows traders to use their full account balance for trading. This means that every dollar in the account can be utilised to open larger positions, potentially leading to higher returns (losses).

- Increased Trading Flexibility: With no traditional margin requirements, traders can quickly adapt to changing market conditions and take more high-quality trade signals than those that are restricted by margin requirements.

- Potential for Higher Returns: By controlling larger positions, traders can amplify their gains. For example, this can be crucial in making the most of a high-quality trading system that is known to provide statistically reliable trading signals.

Disadvantages

- Amplified Potential Losses: The same mechanism that increases potential gains also magnifies losses. A small adverse market movement can lead to significant financial losses, which is why effective risk management is essential.

- Risk of Over-Leveraging: Without the constraint of traditional margin requirements, traders might be tempted to over-leverage their positions. This can lead to rapid account depletion, especially in volatile markets.

- Less room for error: The higher the leverage the greater the accuracy that is required in trade entries.

- Psychological Pressure: Trading with high leverage can be psychologically taxing. The stress of managing large positions and the potential for significant losses can impact decision-making, leading to impulsive trades and mistakes.

Risk Management Strategies

Trading with a high leverage broker can offer substantial profit potential, but realising the profit potential necessitates stringent risk management strategies to protect against significant losses. Here are some key factors that help you to manage risks effectively.

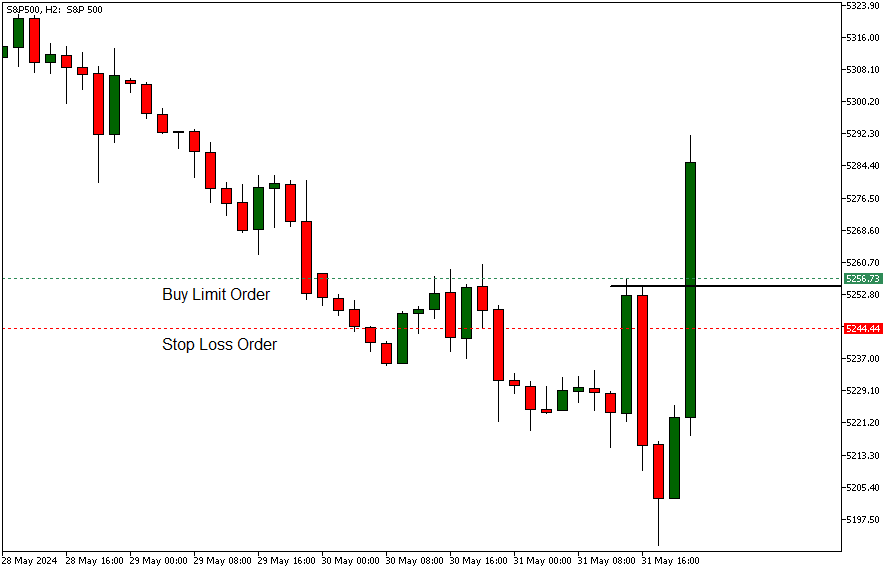

Stop-Loss Orders

Using stop-loss orders is a fundamental risk management technique that losing traders often ignore. Stop-loss orders automatically close a trade when the market moves against the trader by a predetermined amount, limiting the loss to a level specified in the trading plan. This ensures that traders are able to run a viable trading strategy and do not lose more than originally intended.

While it is paramount to use stop-loss orders it is also important not to use stops that are too tight. Stops that are placed too close to the trade entry level are more likely to get triggered by price fluctuations. Therefore, traders should always a) time their buys near to major support levels and b) use a systematic method by which they place stop-loss orders at a safe distance below the trade entry level.

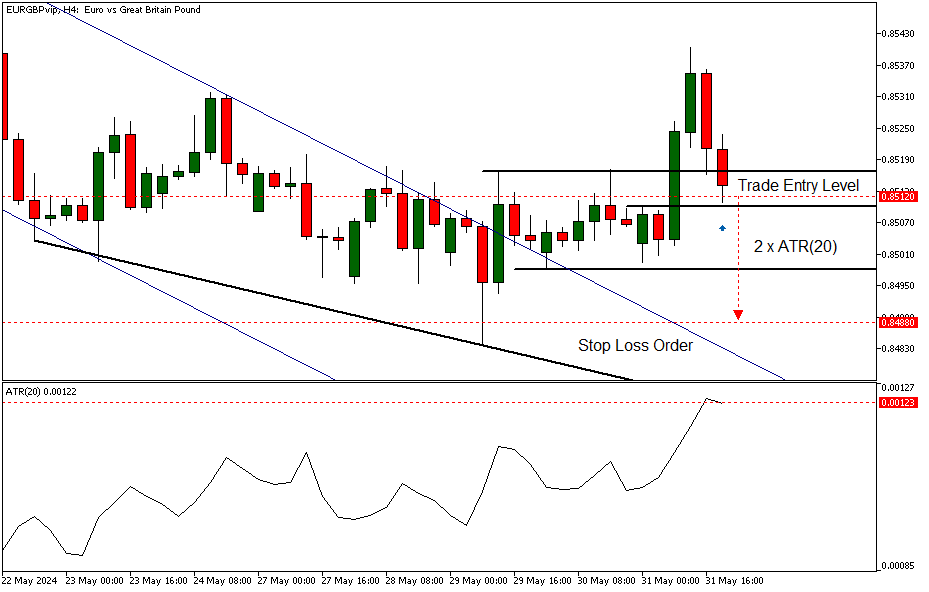

One method widely used by pro traders is to measure one ATR value from the trade entry and place the stop there. The idea is that the ATR value measures the recent volatility and by subtracting it or its multiple from the trade entry level (which hopefully is near to a major support level) , the trader decreases the probability of the price moving down to the stop level significantly.

At the time of writing this EURGBP had retraced back to a support level after breaking out of a bearish trend channel. The idea is that a market that has already moved down (in a bullish context) to the support level is not likely to drop substantially lower by another ATR value (multiple of ATR values).

You should test other lookback periods for the indicator but a 20-period ATR is a good starting point as it measures volatility for the last 20 periods. In the above EURGBP example chart the ATR value is roughly 12 pips and the ATR multiplier used is two. Therefore, the stop is placed 24 pips or two times ATR (20) below the limit buy order.

Position Sizing

Appropriate position sizing is crucial when trading with high leverage. Even when trading with a high leverage broker, traders should only risk a small percentage of their account balance on any single trade. As a rule, new traders should limit their risk per trade to approximately 0.5% of the account balance. This allows them to take at least 50 trades and still have 75% of their trading funds. Traders with more experience and statistics that prove their method makes money can accept significantly higher risk, e.g. 3% per trade.

Keeping in mind that volatility varies and therefore the distance between the trade entry levels and the ATR measured stop is usually different for each trade. However, you can keep the risk per trade e.g. at 0.5% by varying your position size. This means your stop size (entry price minus stop price) determines your position size. Simply put, if the stop size is larger than your position size is smaller and vice versa.

It is also good to remember that the above percentages are guidelines for maximum risk allocation per trade. Traders should consider smaller trade sizes when they feel uncertain about their trade setups. As a rule, the higher the confidence level the bigger the allocation to the trade.

This approach helps to mitigate the risk of significant losses and preserves both actual and mental capital for future trades.

- Regular Monitoring and Adjustments

Continuous monitoring of open positions and market conditions allows traders to make timely adjustments. Trading with a high leverage broker requires vigilance. You must stay on top of any market news that has the potential to move the markets. Regularly reviewing and adjusting trades based on market dynamics can not only prevent substantial losses but in the long run it helps you to achieve your trading goals.

- Diversification

Diversifying trading positions across different assets can reduce risk. By spreading trades across various markets, you can avoid heavy losses from a single market movement. Diversification helps balance potential risks and returns, making the overall trading strategy more robust.

- Utilising Trading Tools and Resources

TIOmarkets provides a range of tools and resources to support traders. Educational materials, market analysis, and trading signals can help traders make informed trading decisions. Utilising these resources can help you to create trading strategies that you can then test with historical data.

TIOmarkets' Unique Features

TIOmarkets stands out as a high leverage broker due to several unique features designed to enhance the trading experience and provide additional security for traders.

Negative Balance Protection

One of the key features of TIOmarkets is negative balance protection. This ensures that you cannot lose more than the balance on your trading account. In other words, you will always have a safety net against volatile market conditions. This feature is particularly crucial when trading with high leverage, as it prevents traders from falling into debt.

Easy to Use Trading Platforms

TIOmarkets offers advanced trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are renowned for their user-friendly interfaces, comprehensive charting tools, and automated trading capabilities. Traders can access a wide range of technical indicators, customise their trading environment, and execute trades efficiently.

Comprehensive Educational Resources

TIOmarkets provides an extensive range of educational resources to support traders at all levels. These include webinars, tutorials, and market analysis reports. By leveraging these resources, traders can improve their knowledge, develop effective trading strategies, and make informed decisions.

Competitive Spreads and Zero Commission Options

As a high leverage broker, TIOmarkets offers competitive spreads across various asset classes. Additionally, traders can choose zero commission trading options, which further enhance cost efficiency. This combination of low spreads and zero commissions helps maximise traders' profitability.

Dedicated Customer Support

TIOmarkets is committed to providing excellent customer support. Traders have access to dedicated support teams available 24/7 via live chat, email, and phone. This ensures that any issues or queries are promptly addressed, enhancing the overall trading experience.

Safety Mechanisms and Account Equity Linkage

To further protect traders, TIOmarkets implements safety mechanisms such as margin calls and stop-out levels. These features help manage risk and protect account equity, ensuring that traders remain within safe trading limits.

Getting Started with TIOmarkets

For those interested in trading with a high leverage broker like TIOmarkets, getting started is straightforward and user-friendly.

Step-by-Step Guide to Opening an Account

Begin by clicking on the "Open Account" button.

- Registration: Complete the registration form with your personal details. Ensure that all information is accurate to avoid any issues during the verification process.

- Verification: Submit the necessary identification documents for verification. This typically includes a valid ID and proof of address.

- Funding Your Account: Once your account is verified, you can fund it using various methods such as bank transfers, credit/debit cards, or e-wallets. TIOmarkets offers multiple funding options to accommodate global traders.

- Selecting an Account Type: Choose the account type that best suits your trading style and leverage requirements. Whether you opt for the Standard account with unlimited leverage, or the VIP Black account with the lowest fees, ensure it aligns with your trading goals.

- Platform Setup: Download and install the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platform. These platforms are renowned for their robust features and ease of use.

- Start Trading: With your account funded and platform set up, you can start trading. Take advantage of the high leverage options to maximise your trading potential.

Tips for New Users

- Utilise Educational Resources: Make the most of TIOmarkets' extensive educational resources to improve your trading skills.

- Practice with a Demo Account: Before trading with real money, use a demo account to familiarise yourself with the platform and test your strategies.

- Implement Risk Management: Always use risk management tools such as stop-loss orders and position sizing to protect your capital.

Customer Support

If you encounter any issues or have questions, TIOmarkets offers dedicated customer support available 24/5 via live chat, email, and phone. The support team can assist with account setup, platform navigation, and any trading-related queries.

In conclusion, starting with TIOmarkets as a high leverage broker is a streamlined process, supported by comprehensive resources and excellent customer service. Whether you are a beginner or an experienced trader, TIOmarkets provides the tools and support needed to succeed in high leverage trading.

Are you ready to start trading with a high leverage broker?

TIOmarkets, a high leverage broker, offers a distinctive trading experience with its unlimited leverage account and comprehensive trading features. The flexibility and potential for higher returns make TIOmarkets an attractive choice if you are looking to maximise your trading potential. Coupled with robust risk management tools and educational resources, TIOmarkets equips traders with everything they need to succeed in high leverage trading. Whether you are a novice or an experienced trader, TIOmarkets provides the necessary tools and support to help you in your trading career. To get started with trading, visit our account opening page.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts